About Our Cost Segregation Program

We are trusted by thousands of companies, CPAs and partners across the country due to our industry expertise and specialized focus.

COST SEGREGATION

Summary of Benefits

Every year, American business owners reinvest billions of dollars into their businesses in the form of physical structures, renovations, and build-outs.

In today’s dynamic business environment, where innovation and staying ahead are paramount, the intricacies of the US tax code may sometimes seem more like an obstacle than the valuable tools they should be. Consequently, failing to segregate build costs and allowing assets to depreciate under the default time frames can result in missed opportunities for optimizing tax benefits and may lead to higher tax burdens in the long run.

With Cost Segregation, your business can break up its slower-depreciating projects into their individual asset components, unlocking tax advantages and mitigating long-term tax burdens. Rewarding you for your investment faster.

COST SEGREGATION

History

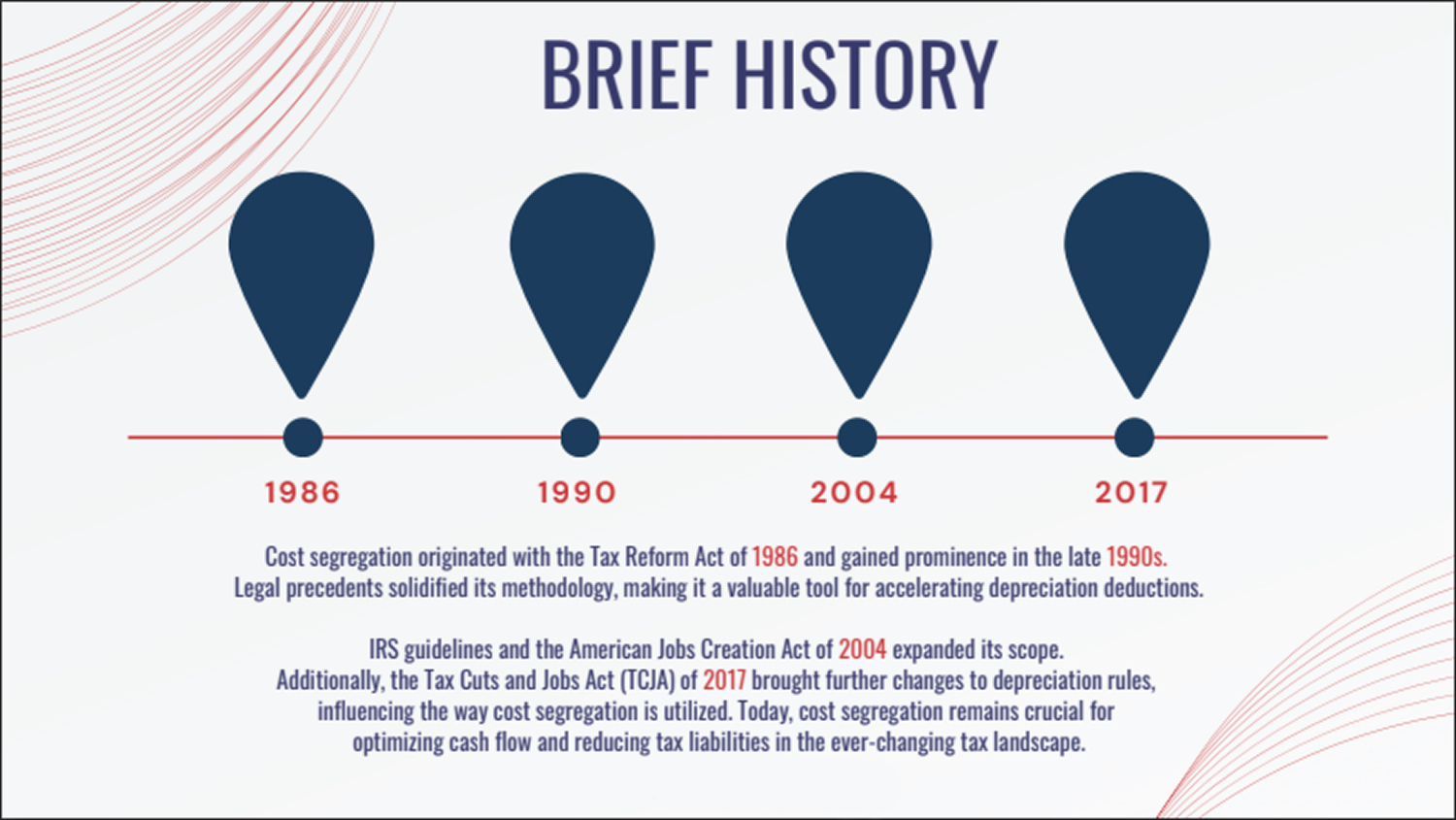

Cost segregation originated with the Tax Reform Act of 1986 and gained prominence in the late 1990s. Legal precedents solidified its methodology, making it a valuable tool for accelerating depreciation deductions.

IRS guidelines and the American Jobs Creation Act of 2004 expanded its scope. Additionally, the Tax Cuts and Jobs Act (TCJA) of 2017 brought further changes to depreciation rules, influencing the way cost segregation is utilized. Today, cost segregation remains crucial for optimizing cash flow and reducing tax liabilities in the ever-changing tax landscape.

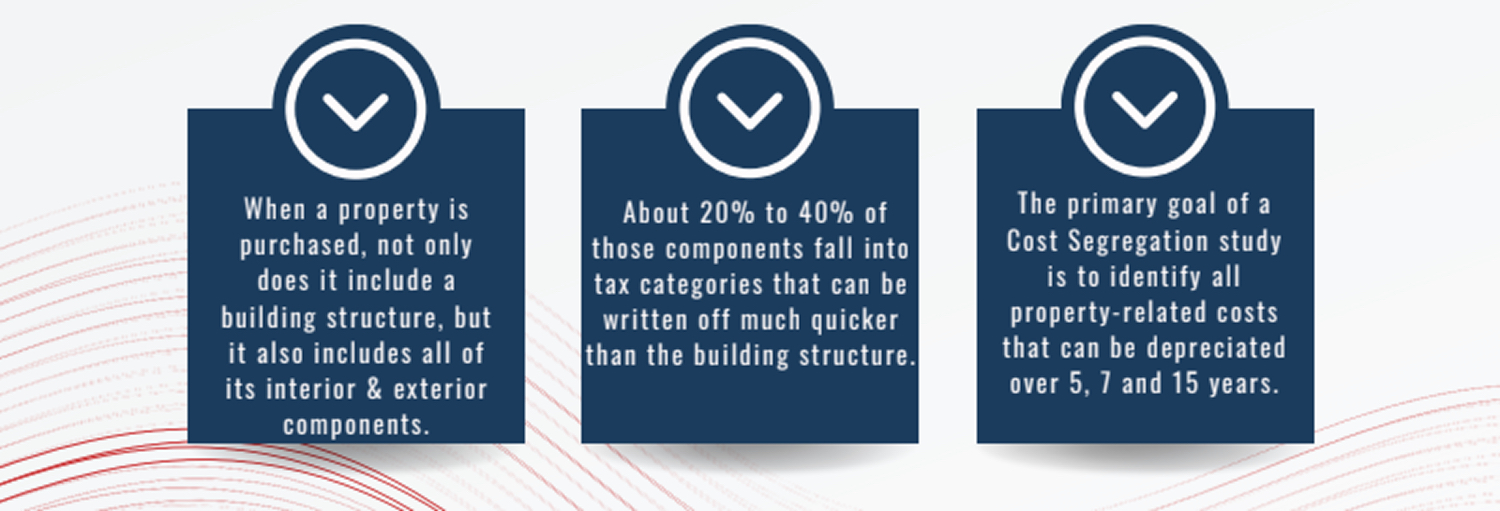

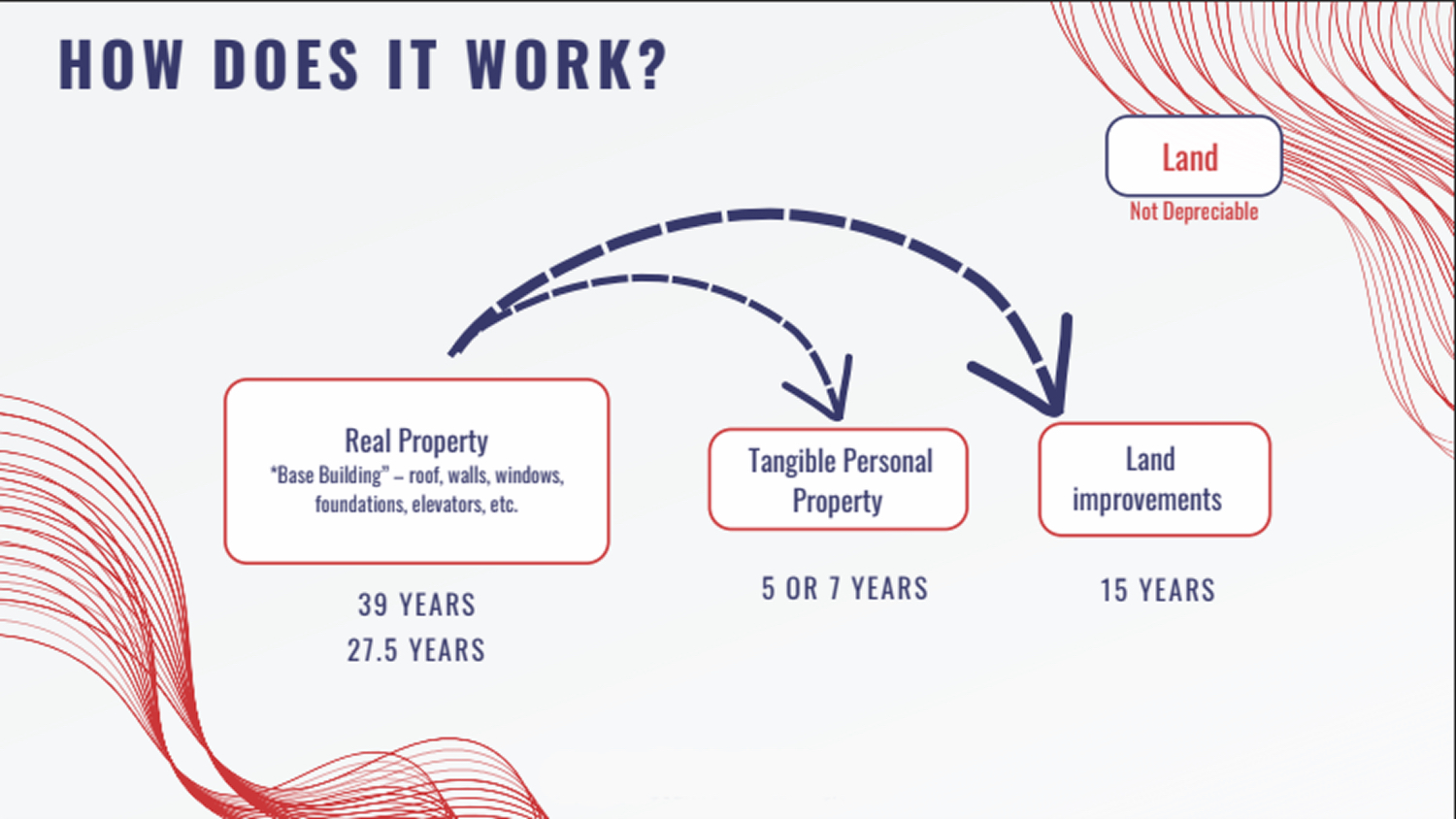

What Is A Cost Segregation Study?

- It looks at the construction cost or purchase price of the property that would otherwise be depreciated over 27 1⁄2 or 39 years.

- In cost segregation, depreciation isn’t increased – it’s accelerated.

-Value of a dollar today vs. value of the same dollar in the future.

CASE STUDIES

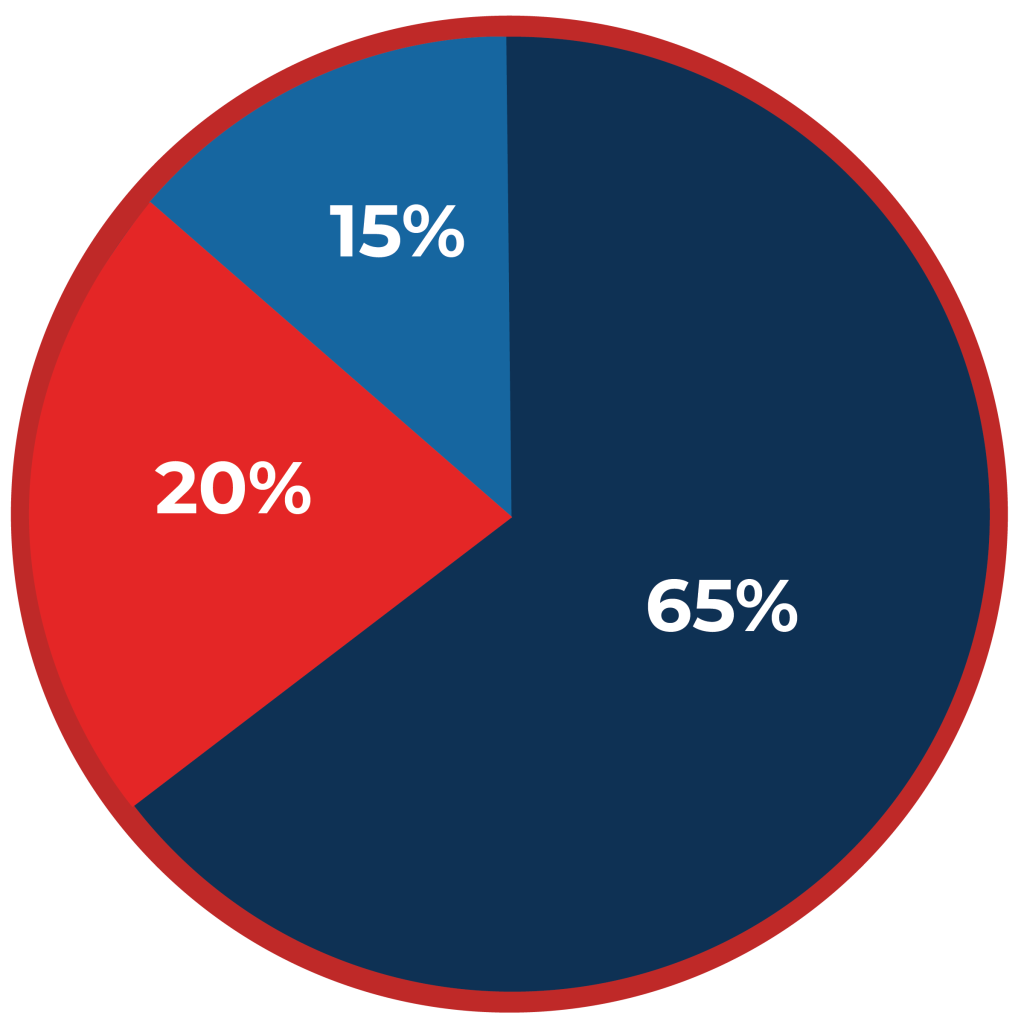

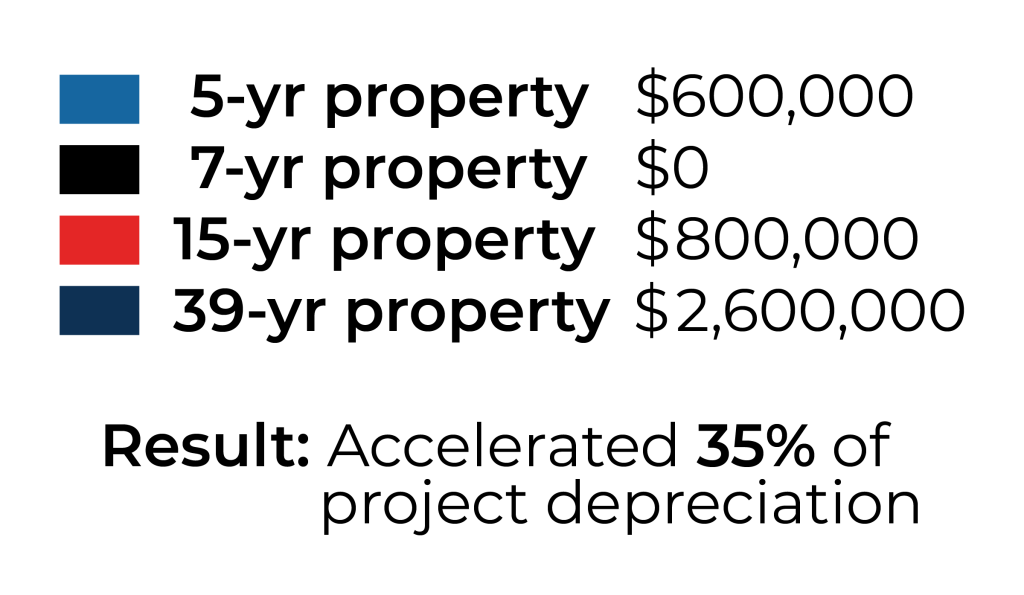

Property Type: Medical Office

Project Summary:

Purchase Price of the Property

(less land): $4,000,000

Building Sq Ft: 15,000

Allocation After Study:

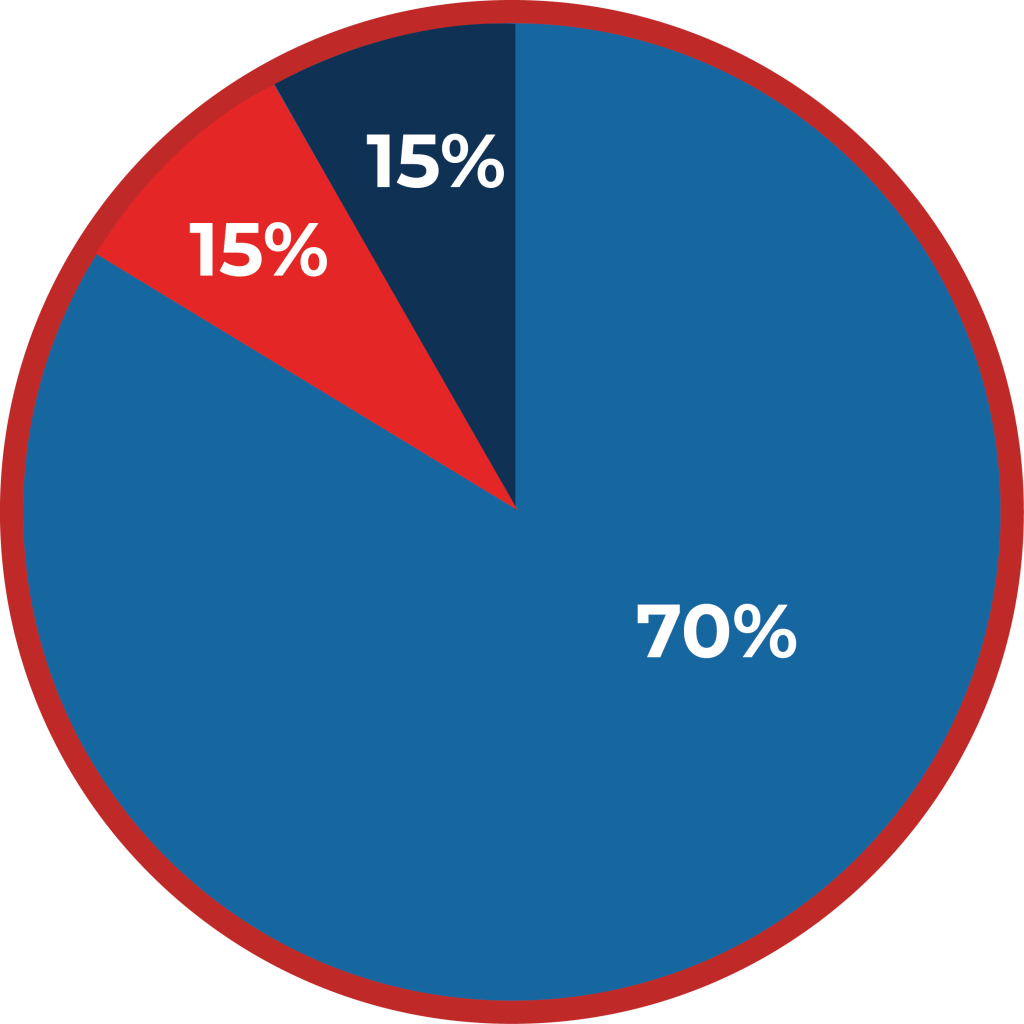

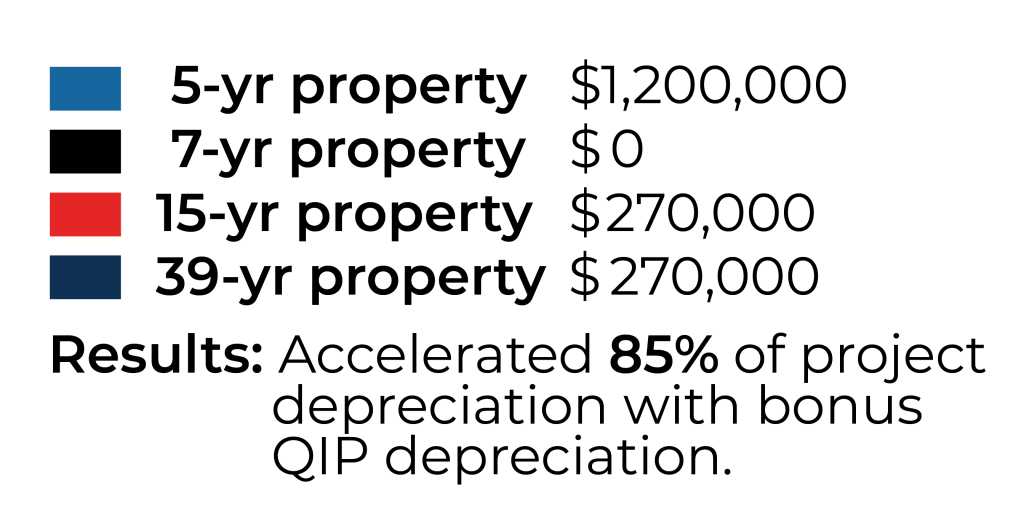

Property Type: Restaurant

Project Summary:

Purchase Price of the Property

(less land): $1,800,000

Building Sq Ft: 1,400

Allocation After Study:

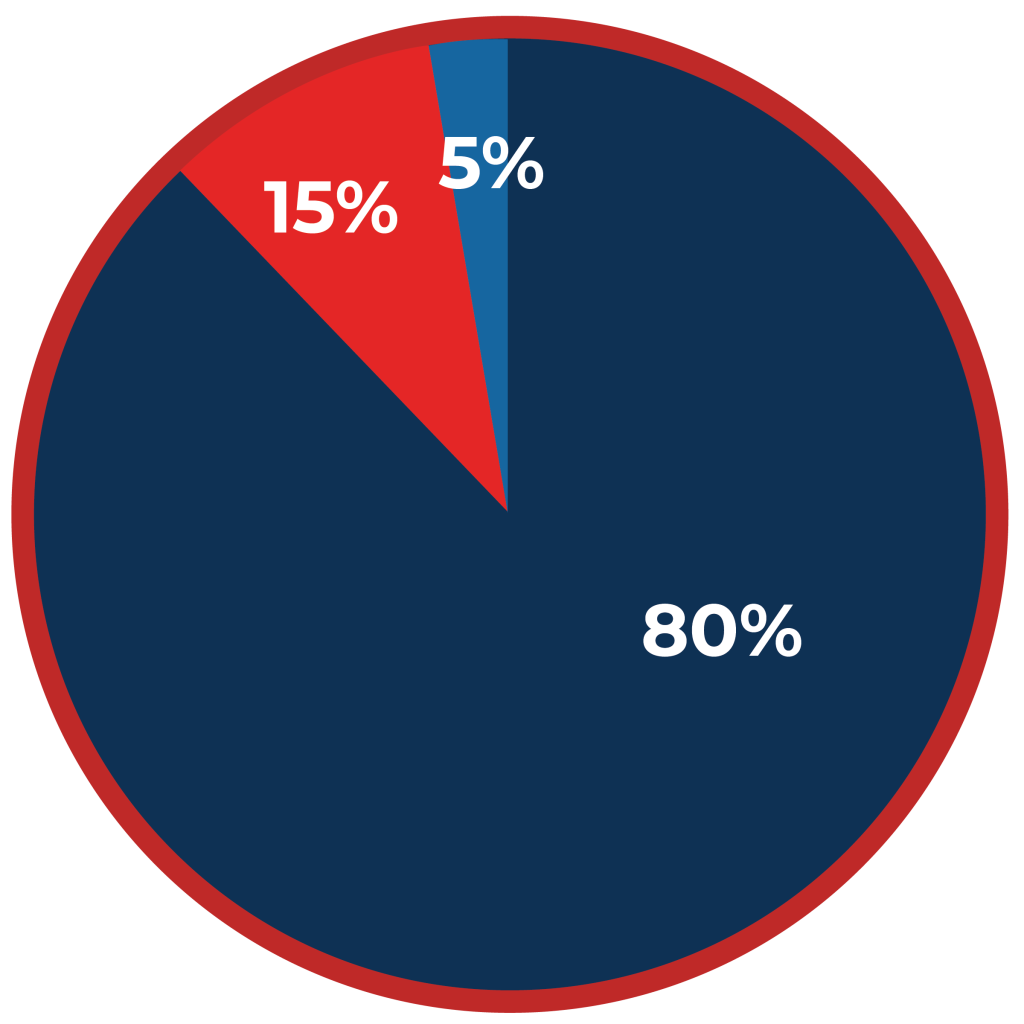

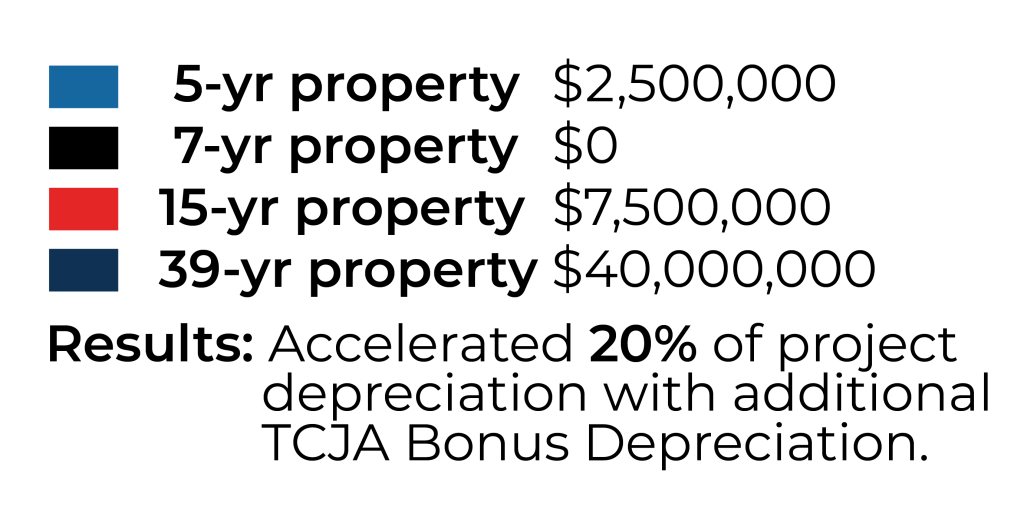

Property Type: Office Building

Project Summary:

Purchase Price of the Property

(less land): $50,000,000

Building Sq Ft: 70,000

Allocation After Study:

MAKING YOUR INVESTMENTS WORK

What Can ATS Do For Me?

Our Cost Segregation program gives you and your tax professional everything you need to optimize your depreciation with confidence.

Included In Our Package:

• A complete cost segregation study on our findings, drafted by expert industry specialists.

• Change of accounting methodology work papers prepared by our staff of in-house CPAs.

• Workpapers in .csv format for easy import by your tax professional, in federal, AMT, and state basis, if necessary.

• Audit defense in case of examination.

Unlocking Value From Your Build Project

Build projects consist of several distinct components which are commonly grouped for tax purposes, leading to less advantageous depreciation.

To maximize immediate benefits, these components should instead be recognized as standalone depreciable items eligible for more favor- able depreciation rates.

Cost Segregation empowers business owners to fine-tune their tax strategy and more quickly realize the rewards of their investments.

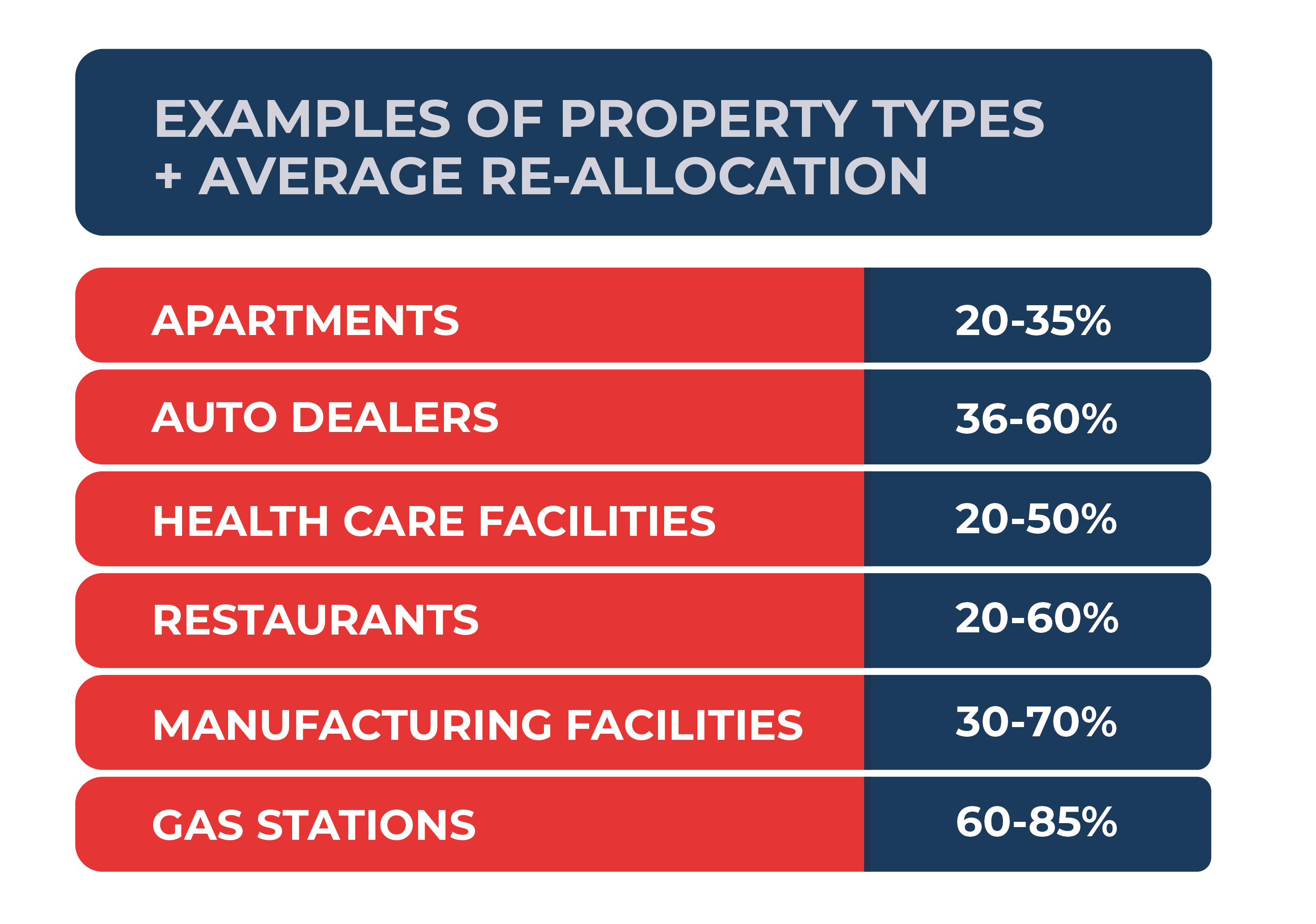

Tax Savings For Every Industry

The specifics of your buildout may change depending on your field, but every industry can qualify.

Ready To Get Started?

Our Core Services Are Self-Employed Tax Credits, Cost Segregation Studies, R&D Tax Credit Studies, 179D & 45L Energy Efficient Deductions.