What Is the Employee Retention Credit?

In order to provide economic relief to businesses and individuals during the Coronavirus pandemic, the CARES (Coronavirus Aid, Relief and Economic Security) Act was signed into law in March 2020. This $370 billion stimulus package makes funding available to small companies, which can be used to allow certain employers who retain employees during the crisis, to claim a tax credit. This tax credit is known as the Employee Retention Credit (ERTC).

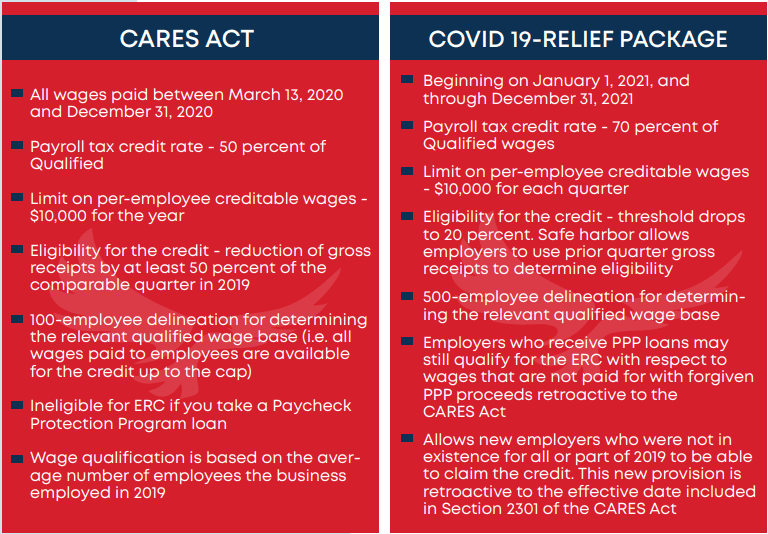

The ERC allows eligible employers to claim a credit against 50% of wages paid per quarter, up to $10,000 per employee annually, for wages paid between March 13, 2020 – December 31, 2020.

The maximum credit is $5,000 per employee. In December of 2020, under the Covid-19 Relief Package, the ERC was extended from January 1, 2021 – December 31, 2021.

This extension allows eligible employers to claim a credit against 70% of wages paid per quarter, up to $10,000 per employee, with a maximum allowable credit of $26,000 per employee.

WHICH BUSINESSES QUALIFY & HOW?

There are 2 ways that a business can qualify for ERC:

1) full or partial suspension of business operations as a result of government order or,

2) a significant decline in revenue compared to the same quarter in 2019. Decline in revenue is defined as equal or greater than 50% for 2020 and equal or greater than 20% for 2021.

HOW DO ELIGIBLE EMPLOYERS OBTAIN THEIR ERC?

American Tax Savings (ATS) will review the relevant financial records to calculate the dollar amount of the eligible employer’s expected credit. ATS will then complete and file the relevant IRS forms for the employer and retain all necessary documentation.

ARE THERE ANY COSTS TO GET STARTED?

Yes, there is a contingency of 20% – but only when employer qualifies and the tax work is completed.

Ready to Get Started?

Why American Tax Savings?

Maximum Credits

Fast Results

World Class Support

Dedicated Professionals

Worry & Hassle Free

Are You Eligible? Let's Find Out!

Our Featured Cases

Here are some tips and methods for motivating yourself. View All Projects