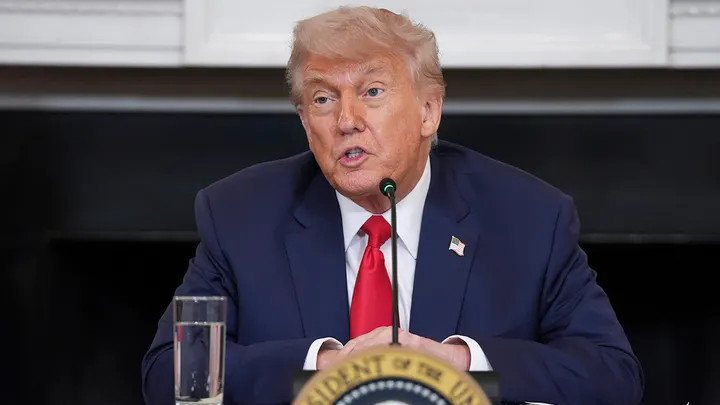

President Trump’s “big, beautiful bill” extending the expiring provisions of the Tax Cuts and Jobs Act and adding more tax breaks is making progress in Congress, with key moves expected in May after lawmakers return from recess.

Earlier this month, House Republicans narrowly passed a budget blueprint echoing the budget outline passed by Senate Republicans. GOP lawmakers plan to use budget reconciliation rules to pass the package by a simple majority to avoid a filibuster by Democrats in the Senate, as they did in 2017 with the TCJA. They also hope to include a debt ceiling increase and border security, energy and defense provisions in the package, along with spending cuts that Democrats warn could threaten Medicaid funding. However, the parameters are still being worked out and only the broad outlines of the overall plan have been approved so far.

Besides extending the individual and pass-through business provisions of the TCJA that weren’t already made permanent, Republicans hope to add more tax breaks such as President Trump’s campaign promises to eliminate taxes on tips, overtime pay and Social Security income.

“I think the final version of the Senate reconciliation instructions gives them a little more breathing room on tax that will allow them to do some things, particularly on the business side, that might have been tough and with less pressure for really painful revenue raisers,” said Dustin Stamper, managing director of tax legislative affairs at BDO USA. “I don’t think they’ll be entirely free of some tough choices between tax priorities, but they certainly got a little more breathing room than they would have had under the original House version.”

Current policy baseline

The bill would raise the debt limit by $5 trillion and cut taxes by up to $5.3 trillion over a decade, likely adding $5.8 trillion to the national debt by 2034. However, Republicans hope to use an assumption called the “current policy baseline” to assert that the $3.8 trillion cost of extending the existing tax cuts would essentially equate to zero, paving the way for $1.5 trillion in additional tax cuts.

“The use of a current policy baseline unlocks a couple new possibilities, but it doesn’t come without its own set of questions,” said Stamper. “There’s not a lot of precedent for using the current policy baseline to score tax provisions under a reconciliation bill.”

When Republicans and Democrats have used the reconciliation maneuver in the past, they’ve left it up to the Senate’s nonpartisan parliamentarian to decide what’s permissible or not under the rules. But the parliamentarian will have less discretion under the current bill.

“What the budget does is essentially asserts that the Senate Budget Committee chair has the authority to determine how scoring works, and the budget specifically lays out that the current policy baseline is essentially appropriate,” said Stamper. “What we heard from the Senate Majority Leader, John Thune, is that they consulted on the budget resolution with the parliamentarian, who apparently deemed it appropriate. But we don’t know how deep that consultation went, whether it went through discussions of all the possible permutations or questions that could arise under that kind of concept. So there is a little bit of lingering uncertainty there on how this could play out.”

Like Stamper, Michael Masciangelo, BDO’s international tax services practice leader, does not anticipate much interference from the Senate parliamentarian.

“I think the tack that was taken by the Senate when they agreed to their parameters was that they felt like they did not need the budget parliamentarian to agree to the scoring approach,” said Masciangelo. “The Senate felt that they had the authority they needed to adopt an approach, whether the parliamentarian agreed to it or not.”

Republicans hope to reverse some of the provisions in the TCJA that were supposed to eventually raise revenue to offset the cost of the 2017 bill after a few years such as amortization of research and development costs and phasing out 100% bonus depreciation.

“What does a current policy baseline mean for something like bonus depreciation, which isn’t just expiring as of a single date, but it’s drawing down over a range of years,” said Stamper. “Or what does a current policy baseline mean for unfavorable business provisions that took effect in 2022 like amortization of research costs, or the less favorable calculation of the limit on interest deduction under 163(j)? Can you include a retroactive extension like that in a current policy baseline?”

Senate Democrats are likely to try to challenge such maneuvers, but they have limited power right now.

“Democrats will absolutely be trying to shred this with budget points of order,” said Stamper. “We’ll see what can fly and what the parliamentarian rules.”

Under reconciliation, every provision generally needs to have a revenue impact that’s not merely incidental, he noted.

“To the extent the current policy baseline means that extensions of expiring provisions have no revenue impact, then do they alternatively run afoul of this separately? Republicans have sort of discussed that, and we’ve heard some rumblings that they could tweak some of the different provisions instead of having a straight extension,” said Stamper. “But we don’t know exactly what that would look like and how much they’d have to tweak them to satisfy the parliamentarian. There’s not a ton of precedent for using that rule on tax provisions, because usually tax provisions inherently have a meaningful revenue impact.”

Debt limit

Republicans had hoped to get the bill to President Trump’s desk by Memorial Day, but that timeline is looking uncertain now as Congress starts looking at other priorities from the Trump administration. The idea of including the debt limit in the bill will affect the timing.

“The debt limit is an interesting thing to include because it might change the timeline of when they need to get a bill done,” said Stamper. “I think they’re looking to work pretty quickly either way, but their drop dead date, technically, under the budget rules, is Sept. 30, 2025 because that’s when the government fiscal year ends. But if they plan to address the debt limit as part of this legislation, then they may need to act sooner than that. CBO’s latest projections say sometime in August or September is likely when they’ll need to act in order to avoid a default. A lot of that is caveated. It could come even earlier than that if government receipts unexpectedly come in low. Now, Republicans can always try and address the debt limit outside of the reconciliation process, but that probably means working with Democrats and may lead to some policy concessions that they don’t want to make.”

SALT cap, carried interest and millionaire tax

Among the tax provisions under consideration are raising the $10,000 limit on the state and local tax deduction in the TCJA. Democrats from high-tax blue states like New York and California have long opposed the so-called “SALT cap,” but now Republican lawmakers in those same states are threatening to withhold their votes if the limit isn’t raised.

“I think they will absolutely have to provide some SALT cap relief in order to get a bill from the House,” said Stamper. “There are enough Republicans that are choosing that hill to die on that I think we won’t see a straight extension of the $10,000 cap. We’ll see some adjustment to it. Where that ends up is going to be subject to some pretty intense negotiations. One of the more recent developments we’ve heard is the tax writers’ first offer seems to be a $25,000 cap. The initial response from what I’ll call the Republican SALT Caucus has been that’s not nearly enough, so we’ll see where that eventually lands.”

President Trump has also called for eliminating the carried interest tax break that mainly benefits hedge fund managers, private equity firm partners and venture capitalists, but lobbyists have successfully defended the tax break in the past.

“This is an interesting issue, because Trump is really the one driving it and he’s mentioned it several times, and targets it specifically,” said Stamper. “There’s a little bit of irony here too, because the current treatment of carried interest is rather unpopular with Democrats, but as much as they’ve yelled about in the past, they’ve never actually passed legislation addressing it. The only time we’ve seen legislation addressing it is when Republicans had single-party control the last time, when the Tax Cuts and Jobs Act extended the holding period. Clearly, it’s in the crosshairs again, but there are going to be a lot of sympathetic Republican members that would like to preserve the current tax treatment. I think their goal is going to be to either try and do something marginal that you know can satisfy or distract the president while still preserving most of the underlying rule”

There has also been talk about having a higher tax rate for millionaires as a way to help pay for the bill, but Trump seems to have dismissed the idea this week, saying it would prompt millionaires to leave the country.

“Some of the hardest core deficit hawks and some members of the Freedom Caucus have floated that trial balloon,” said Stamper: “What if we scale back the tax cuts for folks at the highest income levels, maybe over a million dollars, or something like that. Trump, in private meetings, has expressed openness to that. I think there’s going to be a lot of Republicans, though, that consider their party the party of tax cuts, not tax increases, and will be looking to defend those lower rates as critical to pass-through businesses and things like that. It’s not impossible that something like that moves forward, but I don’t necessarily think it looks extremely likely, notwithstanding some of the chatter that we’ve heard over the last couple of weeks.”

Corporate taxes

During the campaign, Trump called for lowering the corporate tax rate for companies that manufacture in the U.S.

“There’s an interesting dynamic with that one, because Trump really talks about that in terms of a lower rate specifically for domestic manufacturing, and we’re not sure yet exactly what that might mean,” said Stamper. “The easiest concept they can resurrect is an old provision under Section 199 called the Domestic Production Activities Deduction, or DPAD. It was a deduction that gave you an equivalent rate on what it tried to define as manufacturing activities.”

However, such a tax break could be difficult for the IRS to police, especially given the recent cutbacks in its ranks.

“The problem with that provision was that it was hard for the IRS to administer and for taxpayers to comply with, and advisors had cracked it pretty wide open so that there was probably a lot more you could get that deduction on than was originally intended by Congress,” said Stamper. “It’s hard for lawmakers to design and enforce a rate cut on a specific activity like manufacturing. In addition to that, it’s expensive, and one of the things that I’ve noticed is there don’t seem to be a lot of business lobbying groups clamoring for that rate cut right now, which is very different from what it looked like in 2017 when it was all about getting the corporate rate lower for businesses and the administration. That was sort of the centerpiece of the economic agenda and the tax policy. Now that provision is a little more of an afterthought.”

Republicans hope to make more of the provisions in the reconciliation bill permanent, as they did with many of the corporate provisions in the TCJA.

“That’s the biggest benefit for Republicans of the current policy baseline is that they plan to use it to make elements of the Tax Cuts and Jobs Act permanent,” said Stamper. “To the extent they want to go beyond just extensions of the Tax Cuts and Jobs Act and do maybe some enhancements to certain other provisions, or some of the other things they’re talking about, like the new tax cuts Trump has promised, if they want to make those permanent, they would need permanent revenue offsets, so tax increases and things like that could absolutely still be on the table. Carried interest is one. Republicans have targeted the endowment taxes for higher education institutions. They’ve talked about repealing some energy incentives. They have discussed limiting the deduction for state and local taxes for corporations and businesses. So even though the budget resolution, the way the Senate has written it, gives them a little more breathing room, some of these tax increases could absolutely still be on the table.”

Indeed, Trump has talked about eliminating many of the tax incentives for green energy such as wind and solar from the Biden administration’s Inflation Reduction Act, but many of the projects are located in Republican-leaning states, which may make it difficult to end those tax credits.

“In terms of energy credits, I do think they’re not going to be able to pull these up by the roots, in the way that some of the most aggressive rhetoric suggests,” said Stamper. “There is a decent amount of Republican support for some of the energy incentives, because there’s a lot of investment going into red states and red districts. Last year, we saw 18 Republican House members, including 14 who are still in Congress now, write to the House Speaker asking him to preserve some of the energy credits. And his response was we’ll take a scalpel and not a sledgehammer.”

More recently, four Republican senators have written a similar letter calling for the preservation of some of these energy incentives, he noted.

“We could still see some action here, but it’s likely to be in the margins and not a wholesale repeal of these credits,” said Stamper. “In addition, potentially, to the extent there are changes, they’re most likely to be prospective for projects beginning construction after some date in the future, so people with projects already under construction or about to start projects are likely safe.”

International taxes

On the international tax side, there may be some changes as well in the reconciliation bill, although they’re not set to expire like the TCJA’s individual tax provisions. The TCJA included a number of international tax provisions, including global intangible low-taxed income (GILTI), base erosion and anti-abuse tax (BEAT) and the deduction on foreign-derived intangible income (FDII) for U.S. corporations.

“We’re expecting to see in the legislation right now changes in terms of an increase in the BEAT rate, and mechanical change in how the BEAT liability is compared to regular tax liability, by way of which credits are considered, I call them good or bad credits in the current provisions,” said Michael Masciangelo, BDO’s international tax services practice leader. “The GILTI rate is scheduled to go up from a 10 and a half percent rate to 13.125%, absent any extension of the current rules or changes to the rules. And then the benefit of FDII is scheduled to go down from roughly a 13.125% rate on qualifying FDII income to up to roughly 16.4%. Those are the big three.”

There may also be changes in some of the rules for controlled foreign corporations, which were last extended in 2020, but not as part of the TCJA. “It doesn’t get as much press because it wasn’t per se a TCJA item, but the CFC-to-CFC look-through rules, 954(c)(6), are also scheduled to expire as of 12/31/2025,” said Masciangelo. “Those rules, which have been around for quite some time and were temporary from the outset and have been continuously extended, but are scheduled to expire at the end of 2025. We’re watching those things with close interest. We’ll know a lot more in the coming weeks, now that the House agreed to the budget parameters, aligning itself with the Senate in terms of a current policy approach to budget scoring, as opposed to a current law approach, which has been generally speaking used historically for reconciliation bills.”

Other provisions he’s keeping an eye on include Section 174, the R&D capitalization provisions, as well as the Section 163(j) rules limiting the deductibility of business interest expenses.

On the international tax side, the U.S. seems to be pulling away from efforts by the Organization for Economic Cooperation and Development to develop a two-pillar framework to deter corporate tax avoidance. On Inauguration Day, Trump signed an executive order saying, “The Secretary of the Treasury and the Permanent Representative of the United States to the OECD shall notify the OECD that any commitments made by the prior administration on behalf of the United States with respect to the Global Tax Deal have no force or effect within the United States absent an act by the Congress adopting the relevant provisions of the Global Tax Deal.”

It’s unlikely that GOP lawmakers will be trying to bridge the gap with the OECD now, or to support efforts by the United Nations to create a global tax framework after the U.S. delegate walked out of the talks in February.

“I’d be surprised if there was legislation adopted that would enact Pillar One and/or Pillar Two associated legislation as part of the upcoming tax legislation,” said Masciangelo. “I think the administration has been pretty clear as to its view on Pillar One and Pillar Two around sovereign taxing rights. What remains to be seen is if there are attempts, legislatively, in the reconciliation bill to try and adopt any of the provisions combating other jurisdictions that have enacted digital services taxes in some instances and/or certain aspects of the Pillar Two legislation.”

He noted that the Treasury Department has been studying the issue of taxes levied in other countries, but has not yet released its report.

“That report has not been made public in terms of the review of countries that are at least under the guidelines that were highlighted in the executive orders or memoranda from the administration to examine countries to determine whether they had regimes or laws that would discriminate against U.S. companies,” said Masciangelo. “That report is out there. I doubt that we’ll see it, at least in the coming weeks. And, whatever is in that report, and some of the recommendations may or may not find their way into tax legislation as revenue raisers, I think it’s a difficult thing to do because of treaties and other types of things that need to be considered.”

The report may look at issues such as digital services taxes, value-added taxes, top-up taxes and the OECD’s undertaxed profits rule. The OECD is still hoping to work with the U.S. and other recalcitrant countries on a way forward.

“At least in the public press, I think the OECD continues to state that they feel like they can work with the U.S. around Pillar Two and try to come to an agreement on items, whatever those agreements may or may not be,” said Masciangelo. “There are also other big countries besides the U.S. that are members of the OECD that have yet to adopt Pillar Two legislation as well. So we’re not alone in the U.S. in terms of not having advanced domestic law to adopt Pillar Two provisions like you’ve seen in many other places around the world.”

It will be up to the IRS and the Treasury to develop regulations around any legislative changes, which may be difficult to do given the budget cuts and layoffs.

“Unless they change the mechanics or certain key definitions of items in the reconciliation bill related to BEAT, GILTI and FDII, I think the regulations that exist now will suffice in terms of anticipating the changes to the rates and mechanics that will happen in 2026,” said Masciangelo. “Those changes were already considered in the rather substantial regulation packages that were issued post TCJA up until now for those particular provisions when they were released. If we see fundamental changes to any of those regimes, and it requires regulations to supplement what we already have, I think you might expect to see some movement on those regulations. Even with the first Trump administration, when there was a heightened scrutiny on proposing regulations and needing to remove a certain subset of other rules or regulations in response, there was, generally speaking, an exception to that to issue regulations related to the TCJA itself. I would imagine that same point of view would likely apply to any new or significantly changed provisions in the current reconciliation bill, but we’ll have to see.”